Jun 20, 2023

WisdomTree Files to Start a US Spot Bitcoin ETF on the Heels of BlackRock’s Application

, Bloomberg News

(Bloomberg) -- BlackRock Inc.’s surprise filing for a US spot Bitcoin exchange-traded fund last week has lead to a flurry of similar applications from rival issuers and speculation that the asset manager has key insights that will lead to approval of its application.

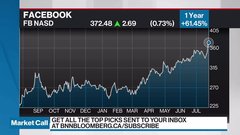

Bitcoin has jumped more than 20% since the filing to more than $30,000. On Tuesday, Invesco Ltd. renewed its application for the physically-backed Invesco Galaxy Bitcoin ETF within hours of WisdomTree’s filing with the Securities and Exchange Commission for the WisdomTree Bitcoin Trust. Days earlier, Bitwise submitted plans for a similar vehicle.

The rush of applications comes in the wake of BlackRock’s bid to launch the iShares Bitcoin Trust, which landed with US regulators last week. Given BlackRock’s status as the world’s biggest money manager with roughly $9 trillion, the filing is being taken as a sign that the SEC might finally give the green light to a physically-backed Bitcoin ETF — a structure the regulator has repeatedly rejected, citing risks such as fraud and manipulation in the spot market for the token.

“When the world’s largest asset manager makes a move like this, other issuers are going to take notice because the stakes are so high in the Bitcoin ETF race,” Nate Geraci, president of advisory firm The ETF Store. “There has been absolutely no indication that the SEC is ready to entertain a spot Bitcoin ETF. The likely assumption is that BlackRock may know something.”

BlackRock declined to comment on the speculation Wednesday. At the time of the filing, a spokeswoman cited regulatory restrictions.

In addition to the rally in Bitcoin, the Grayscale Bitcoin Trust (ticker GBTC)’s discount to its net-asset value has narrowed.

Industry proponents such as Gemini Trust Co.’s Cameron Winklevoss have been quick to cite the rebound to champion the digital currency after what’s been a rough spate that included scandals, bankruptcies and regulatory actions.

The renewed push for a spot Bitcoin ETF follows a long line of rejections. There have been about 30 attempts for such a product, according to a tally from Bloomberg Intelligence. Now, with BlackRock throwing its hat into the ring, there’s likely more to come, in the eyes of Dabner Capital Partners’ Dave Abner.

“Everyone who had a filing is going to resubmit and those who had been considering will also want to be filing soon as well,” said Abner, principal at Dabner Capital Partners, an ETF and crypto advisory firm.

(Adds that BlackRock declined to comment in the fifth paragraph.)

©2023 Bloomberg L.P.