Jun 20, 2023

BlackRock’s Surprising Bitcoin ETF Filing Helps Repair Grayscale GBTC Discount

, Bloomberg News

(Bloomberg) -- BlackRock Inc.’s surprise application for a spot-Bitcoin exchange-traded fund has a silver lining for Grayscale Investments LLC.

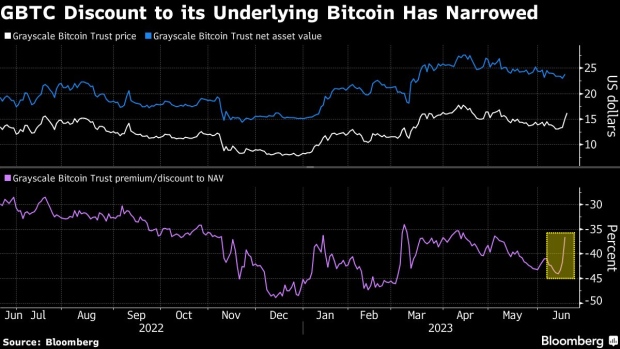

The $16.9 billion Grayscale Bitcoin Trust (ticker GBTC) has outperformed the cryptocurrency itself in the days since the world’s largest ETF issuer applied for the iShares Bitcoin Trust last week. As a result, GBTC’s discount to its underlying Bitcoin holdings has narrowed to about 37%, versus 44% a week ago.

While the proposed BlackRock fund would be a competitor to GBTC if approved, the trust’s discount is shrinking as investors wager that Grayscale’s bid to convert it into an ETF now looks more likely. Even though the US Securities and Exchange Commission has repeatedly rejected physically backed Bitcoin ETFs, citing manipulation concerns and a lack of investor protections, BlackRock’s application is being taken as a sign that the regulator might have a change of heart, according to Bloomberg Intelligence.

“BlackRock’s filing for a spot Bitcoin ETF has restored hope in approval thanks to the company’s size, stature and reputation,” Bloomberg Intelligence ETF analysts Eric Balchunas and James Seyffart wrote in a report. “BlackRock likely didn’t make the decision lightly and is used to working with regulators and the government at large.”

Shares of GBTC have jumped around 23% since the BlackRock application was first reported on June 15. Bitcoin is up about 8% during the same period.

Grayscale is currently in the midst of a high-profile legal battle with the SEC. The asset management sued the regulator last June after it denied Grayscale’s application to turn GBTC into a physically backed ETF.

Turning GBTC into a spot Bitcoin ETF would solve a persistent problem for Grayscale: the trust’s discount. Unlike an ETF, GBTC can’t redeem shares to shift with fluctuating demand, which has dragged the trust to a deep discount relative to its underlying Bitcoin holdings.

“If the BlackRock ETF is approved, then there would be precedent to approve more physically settled ETFs,” said Stephane Ouellette, chief executive of FRNT Financial Inc, an institutional platform focused on digital assets.

--With assistance from Vildana Hajric.

©2023 Bloomberg L.P.