Jun 20, 2023

Bull Market ‘FOMO’ Finally Sends Stock ETF Haul Past Bond Funds

, Bloomberg News

(Bloomberg) -- What was billed as the year of fixed-income is morphing into a massive game of catch-up for investors trying to capture some of the stock market’s gains.

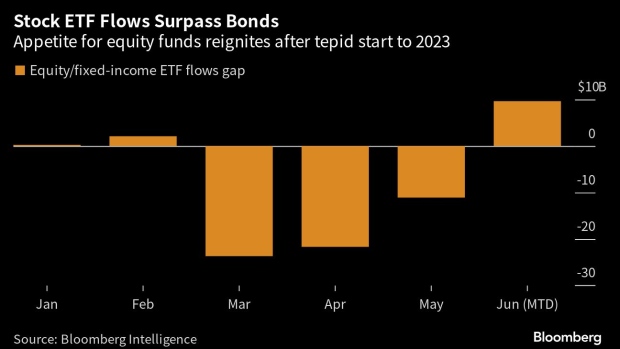

After a tepid start to 2023, nearly $102 billion has flowed into equity exchange-traded funds so far this year, according to data compiled by Bloomberg. That compares to $93 billion for fixed-income ETFs, which had been sitting on a bigger year-to-date haul than stock funds up until this month.

The shift fits with an old adage in investing: flows follow performance. Optimism that the Federal Reserve is nearing the end of its tightening cycle combined with a better-than-feared earnings season and growing hype around artificial intelligence has pushed stocks back into bull-market territory after a bruising 2023.

Double-digit gains are fueling a “fear of missing out” impulse among money managers, according to Kim Forrest of Bokeh Capital Partners, defying calls from the start of the year that a looming recession would benefit bonds over stocks.

“Retail investors are not the only ones susceptible to FOMO,” said Forrest, chief investment officer and founder of the investment firm. “People now understand that the view of most of the experts in the beginning of this year were wrong, and they are moving back into stocks to try and catch up.”

The $407 billion SPDR S&P 500 ETF Trust (ticker SPY) has returned 15% this year, while the technology-heavy $201 billion Invesco QQQ Trust Series 1 (QQQ) has gained 38%, data compiled by Bloomberg show. By comparison, the $94 billion Vanguard Total Bond Market ETF (BND) has climbed 2.7% on a total return basis.

The stock market’s dominant performance has redirected traffic in the $7.3 trillion ETF arena, with equity ETFs now pulling in nearly $10 billion more year-to-date than their fixed-income counterparts. At the end of March, bond funds were sitting on a lead of nearly $24 billion, Bloomberg Intelligence data show.

But even with the reignited appetite, inflows into equity ETFs so far in 2023 pale in comparison to previous years. Stock funds had absorbed nearly $208 billion halfway through 2022, leading to a full-year influx of nearly $400 billion.

However, with cash starting to exit money-market mutual funds and interest in leveraged equity funds picking up, inflows could accelerate from here, according to Bloomberg Intelligence’s Athanasios Psarofagis.

“The drought is over,” ETF analyst Psarofagis said. “It does seem a bit late, but it could also be that now since we’re technically in a bull market, lots of model signals are liking stocks again.”

©2023 Bloomberg L.P.