6h ago

Tiny Issuer to Debut the Only US Double-Bitcoin Futures ETF

, Bloomberg News

(Bloomberg) -- If Bitcoin’s famous volatility doesn’t give you enough of an adrenaline rush, you might soon be able to get two-times its returns.

Volatility Shares is planning to launch the 2x Bitcoin Strategy ETF (ticker BITX), which would offer double the performance of the S&P CME Bitcoin Futures Daily Roll Index each day. The debut is potentially slated for Tuesday, according to the company’s website. Stuart Barton, its chief investment officer, confirmed to Bloomberg News that the fund is expected to start trading on June 27.

While other funds with amped-up returns already exist, Volatility Shares, which manages $160 million across three funds, would be the only one in the US to give two-times the returns of Bitcoin, a cryptocurrency known for its wild price swings. BITX would carry a 1.85% expense ratio, according to data compiled by Bloomberg. The ETF would not hold Bitcoin directly, but would look to benefit from increases in the price of Bitcoin futures contracts each day, according to a filing.

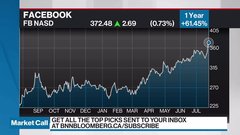

It all comes amid hype over BlackRock Inc.’s shock filing for a US spot Bitcoin exchange-traded fund, which some market-watchers see as a potentially good sign for such a product to finally get approval from regulators, given the asset manager’s stature — though nothing is assured at this point, as plenty of issuers have been rebuffed by the US Securities and Exchange Commission in the past. The price of Bitcoin on Friday, though, reached its highest since June 2022, touching $31,410 at one point.

“I think this could be a breadcrumb signifying that the SEC may be taking a more lenient stance towards Bitcoin compared to the very adversarial stance they have had over the last few years,” said Bloomberg Intelligence ETF analyst James Seyffart.

Two other issuers have over the last couple of weeks quietly pulled applications that proposed to offer products similar to BITX. Direxion had withdrawn its Bitcoin Strategy Bull 2X Shares filing, which had proposed to double the performance of the S&P CME Bitcoin Futures Index each day. Earlier in the month, ProShares, another issuer, rescinded its UltraBitcoin Strategy ETF application, according to a filing with the Securities and Exchange Commission.

It is unclear how BITX differs from the ETFs proposed by the other two firms.

Issuer Valkyrie, however, has a live application for its Bitcoin Futures Leveraged Strategy ETF, which would be actively managed and would provide variable leverage. Valkyrie already has a Bitcoin futures ETF trading.

To be sure, despite recent hype, cryptocurrencies have been under strict scrutiny, with US regulators most prominently cracking down on digital-asset exchanges. The SEC recently accused some platforms of running illegally. At the same time, asset-manager Grayscale Investments is mired in an ongoing lawsuit against the SEC in which it’s attempting to convert its Bitcoin trust into an ETF.

A spot Bitcoin ETF does not exist in the US, though proponents have long argued for one. The first Bitcoin-futures fund, however, debuted in late 2021 to massive fanfare. A few such products currently trade.

“At face value it will look ridiculous to have a 2x-leveraged Bitcoin Futures ETF trading on US exchanges while at the same exact time they are fighting Grayscale in court and denying every other issuer’s attempt at launching a spot Bitcoin ETF,” Seyffart added.

With three ETFs currently trading, Palm Beach Gardens, Florida-based Volatility Shares started in 2019 and is known for its leveraged and inverse ETFs. It manages $160 million across its three funds — the 2x Long VIX Futures ETF (UVIX), the -1x Short VIX Futures ETF (SVIX) and the -1x Short VIX Mid-Term Futures Strategy ETF (ZIVB).

--With assistance from Sam Potter.

(Updates with Valkyrie details in eighth paragraph.)

©2023 Bloomberg L.P.