14h ago

BofA Strategist Says UK Is ‘Stagflationary Sick Man of Europe’

, Bloomberg News

(Bloomberg) -- Bank of America Corp. strategists characterized the UK as the “stagflationary sick man of Europe” as they listed reasons why the country is so unappealing to investors.

“Heard anyone say anything good about the UK recently? No, nor have we,” BofA chief investment strategist Michael Hartnett wrote in a note.

In addition to stagflation — a combination of high prices and economic contraction — Hartnett referenced labor strikes, a “crumbling” National Health Service, 6% mortgage rates, and a UK yield curve that’s the most inverted since 2000.

His conclusion: “Buy humiliation, sell hubris!”

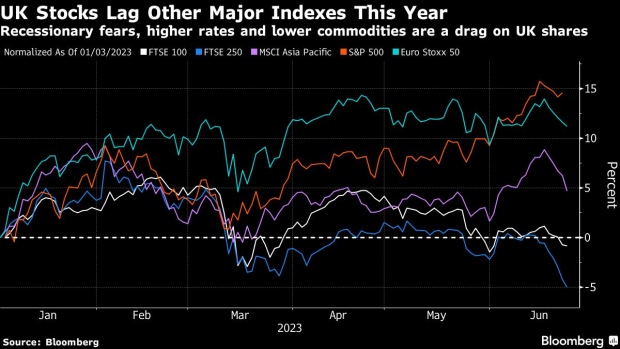

UK equity indexes are 2023’s worst performers among major European and developed-market gauges as high inflation pushes the Bank of England to persist with interest-rate hikes that are putting pressure on the economy and squeezing consumers through bigger mortgage payments. Investors are now betting that British policy makers will raise interest rates to 6.25%, the highest in more than two decades.

Traders Bet BOE Will Raise Rate to 6.25%, Highest Since 1998

UK equity funds have recorded outflows for each of the last 24 weeks, with just one week of inflows this year and only seven in the past 18 months, BofA said, citing EPFR Global data.

Pointing to the discount of the FTSE 250 Index versus global peers, Hartnett said UK midcap stocks are a “great contrarian investment” to put away for a few years, that needs peak gilt yields to trough.

©2023 Bloomberg L.P.