Jun 16, 2023

Canadians say higher rates are crimping their personal spending

, Bloomberg News

We're seeing two types of consumers emerge: Buggy CEO

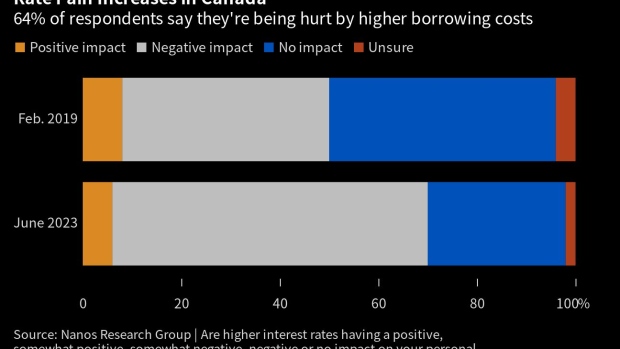

Nearly two-thirds of Canadians say higher borrowing costs are squeezing their pocketbooks, a result that’s at odds with a recent rebound in household consumption.

Some 64 per cent of Canadians say higher interest rates are having a negative or somewhat negative impact on their personal spending, according to a Nanos Research Group survey conducted for Bloomberg News. Another 28 per cent said there was no impact, while 6 per cent said the impact was positive.

The survey may raise questions about why a spending slowdown hasn’t yet shown up in the data. Recent gross domestic figures showed household consumption rebounded in the first quarter, rising at an annualized 5.7 per cent pace, the fastest since the beginning of last year. Statistics Canada will publish fresh retail sales numbers next Wednesday.

The poll took place just before the Bank of Canada surprised markets by ending its conditional pause and raising its benchmark overnight rate to 4.75 per cent last week, a move it said was the result of strong economic momentum. Before that, the central bank increased rates by more than 4 percentage points between last March and January of this year.

“Interest rates are increasingly a factor in deferring major purchases. This is especially so among younger and working-aged consumers in Canada,” Nik Nanos, founder of the firm, said by email. “Upward movement on interest rates will likely have a material impact on spending.”

The survey also shows rate hikes are having a disproportionate impact on younger people. Some 76 per cent of Canadians aged 18 to 34 are more likely to say inflation has had a negative impact, compared with 52 per cent over 55.

The Nanos poll of 1,096 Canadians was conducted online and by telephone between May 31 and June 3. It has a margin of error of 3 percentage points.