Jun 21, 2023

Retail Army Bets Record $1.5 Billion on Stocks at Fastest Pace Ever, JPMorgan Says

, Bloomberg News

(Bloomberg) -- If the momentum in US stocks is getting extended, retail investors — whose risk-on appetite just hit a new high — don’t want to hear about it.

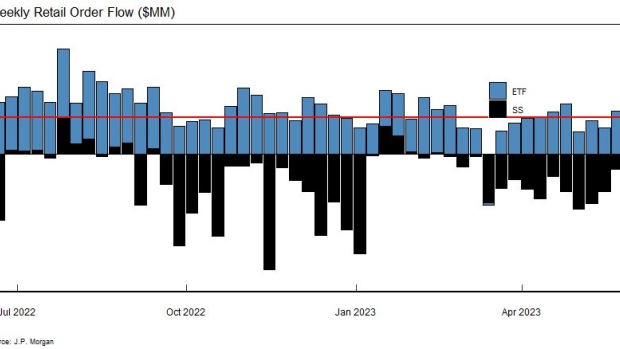

Undeterred by a rally that had already pushed the S&P 500 up 14% this year, non-professional investors bought $1.5 billion of single stocks in the week ending Tuesday, an all-time high, according to data compiled JPMorgan Chase & Co. strategist Peng Cheng. Flows including exchange-traded funds and individual stocks topped $4.4 billion, the data show.

Most of the inflow into single stocks went into just three names — Tesla Inc., Apple Inc. and Nvidia Corp. — in a bet that a record-shattering run in the tech-related shares is poised to continue. The three stocks alone have accounted for 43% of the S&P 500’s gains this year, based on data compiled by Bloomberg.

Retail traders, the market’s most-avid dip buyers in the post-Covid rally, are now catching up to this year’s rip in tech-related megacaps that took many investors more broadly by surprise. How timely the retail crowd’s foray into these high-flyers is is anyone’s question. Nvidia is down 1.2% at 9:42 a.m. on Thursday, while Tesla is trading 1.6% lower.

The growing appetite for stock exposure among amateur traders comes as their professional colleagues were recently forced to abandon their cautious stance and hop on the buying binge. At Bank of America Corp., clients put $4.5 billion into US stocks last week, the most since October, with hedge funds and institutions leading the inflows. At Goldman Sachs Group Inc., gross leverage among clients is sitting at a five-year high. Tesla is down 2% so far this morning, while

Rising animal spirits among retail investors is showing signs of extreme sentiment in all things tech and AI. A 36% rally in the Nasdaq 100 Index this year pushed the gauge to trade 24% above its 200-day moving average earlier this week, a gap seen less than 4% of the time ever, data compiled by Bloomberg show.

The last time the reading was this high was in late August 2020, which preceded a 13% drop over the next month. When the reading was this high for a handful of sessions in September 2009, the Nasdaq 100 proceeded unscathed. Before 2009, the Nasdaq 100 was this disconnected from its long-term moving average in early April 2000, when the dot-com boom was starting to go bust.

(Updates with Thursday equity moves in fourth paragraph.)

©2023 Bloomberg L.P.