17h ago

Philippines Names Ex-BIS Official Remolona as Central Bank Chief

, Bloomberg News

(Bloomberg) -- The Philippines has named Eli Remolona, a member of the central bank’s policymaking board, to head the monetary authority as it strives to curb price pressures and shield economic growth.

Remolona, 70, will succeed Felipe Medalla whose term ends July 2, according to a statement on Friday from President Ferdinand Marcos Jr.’s communications office.

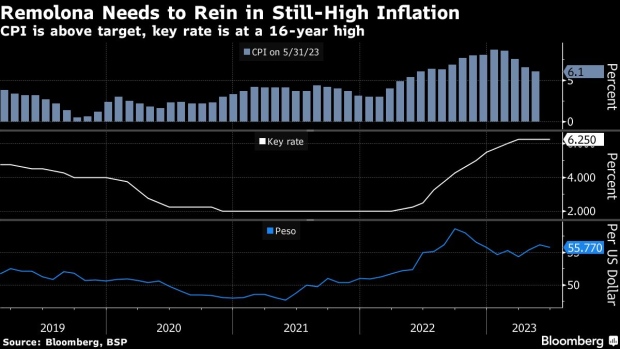

The incoming governor of the Bangko Sentral ng Pilipinas, who will serve a six-year term, inherits challenges that include above-target inflation and borrowing costs already at a 16-year high, which threatens to slow one of the region’s fastest-growing economies.

Remolona, who worked at the Bank for International Settlements for almost two decades and at the Federal Reserve Bank of New York for 14 years, is expected to make returning inflation to the bank’s 2%-4% target a priority.

It helps that he is no stranger to price pressures caused by supply disruptions. As professor of finance and director of Central Banking at the Asia School of Business in Malaysia, he ran a masters course for young policymakers on how the flow of goods influenced consumer prices.

“With his extensive global experience and expertise in financial markets and regulations, we are confident that Dr. Remolona will anchor the Philippine banking industry not only towards continuous stability of the financial system, but also to growth and competitiveness in the regional stage,” Jose Teodoro K. Limcaoco, president of the Bankers Association of the Philippines, said in a statement.

Prior to joining the Philippine central bank’s monetary panel in August 2022, Remolona served as independent director at the Bank of the Philippine Islands. He holds a PhD in economics from Stanford University.

Finance Secretary Benjamin Diokno, a former central bank governor himself, said he expects continuity at BSP under Remolona. “Monetary policy is his life,” Diokno told reporters.

Marcos made the decision to appoint Remolona “after extensive consultations” with the finance department, private banks, financial institutions and other government agencies, his communications office said.

The announcement comes hours after Medalla said the central bank will probably keep its benchmark interest rate steady for the rest of the year.

Medalla, a longtime economics professor, took the helm as governor a year ago to continue Diokno’s remaining term, and led one of the most aggressive tightening campaigns in the region.

In a statement, Medalla said he’s “honored” to hand over the reins of the BSP to Remolona, adding he’s “fully capable of leading the central bank in pursuing its mandates of promoting price and financial stability, and a safe and efficient payments and settlements system.”

--With assistance from Andreo Calonzo, Karl Lester M. Yap and Ditas Lopez.

(Updates with bankers association’s comments.)

©2023 Bloomberg L.P.