9h ago

Templeton-Led Fund Starts Record $1.9 Billion Romanian IPO

, Bloomberg News

(Bloomberg) -- A Romanian fund aims to raise as much as 8.7 billion lei ($1.9 billion) in an initial public offering of its minority stake in hydropower producer Hidroelectrica SA, kicking off what’s expected to be the largest-ever new listing on the country’s market.

Closed-end fund Fondul Proprietatea SA, which is managed by Franklin Templeton Investments, is seeking to sell about 17.3% of its 20% holding in Hidroelectrica, the prospectus filed on Friday shows. Indicative demand exceeds the full deal size hours after the offering started, according to terms seen by Bloomberg News.

While state-controlled Hidroelectrica won’t directly gain cash from the IPO, a successful listing would open up new funding opportunities for its ambitious investment plans. It could also help the Bucharest Stock Exchange secure a long-awaited upgrade to emerging-market status by MSCI because of the boost in liquidity.

Furthermore, the sale of a minority stake in the power producer would fulfill one of the milestones in Romania’s recovery and resilience plan, helping to unlock €29 billion ($31.5 billion) in European Union funding.

“Even as the valuation range is not cheap, and there is some risk of possible state regulation of electricity prices in the future, it may be a success that will again open an IPO window in the region,” according to Michal Semotan, a portfolio manager at Prague-based J&T Investicni spolecnost. “We want to place the bid, as we are long in the energy sector.”

Fondul wants to sell 78 million shares at 94 lei to 112 lei apiece in Bucharest. The offer in the green-energy producer, majority owned by the government, may come close to the record eastern European share sale held by Poland’s Allegro.eu SA, which raised $2.3 billion in 2020.

Read more: A $12 Billion Utility Races to Tap Wind and Solar Amid IPO

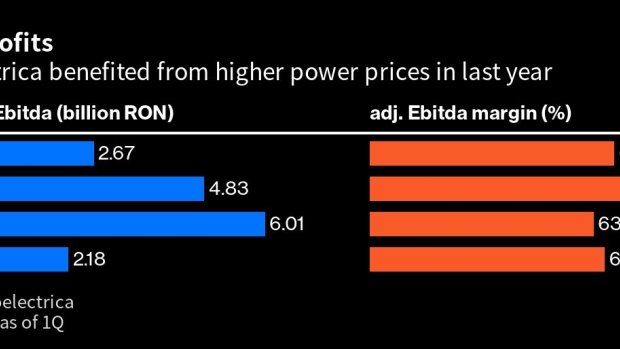

Like other energy producers in Europe, Hidroelectrica saw revenue jump last year as Russia’s invasion of Ukraine triggered a spike in prices on the continent. The company’s net income rose about 45% year-on-year roughly 4.5 billion lei. Its profit rose 34% in the first quarter this year to 1.7 billion lei, according to data released by Fondul.

To be sure, energy producers are likely to start feeling the pinch and prices stabilize, while European Union governments step up support for consumers. Still, Hidroelectrica’s dividend policy, which envisages returning 90% of profits to shareholders and even potential extraordinary payouts, may increase the stock’s attractiveness.

The prospectus also mentions the option of overallocation, depending on the demand, that could allow Fondul to sell its entire stake in the company. Subscription period starts on Friday and is expected to close on July 4.

--With assistance from Konrad Krasuski and Simon Lee.

(Updates with details about demand in the second paragraph)

©2023 Bloomberg L.P.