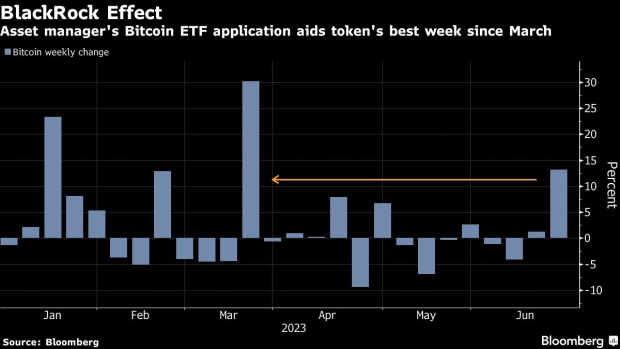

(Bloomberg) -- Bitcoin is heading for one of its strongest weeks of the year, buoyed by speculation that proposed exchange-traded funds potentially herald new sources of demand for the largest digital asset.

The token edged below $30,000 as of 10:05 a.m. Friday in Singapore, leaving it on course for a 13% weekly gain, the most for such a timespan since March. Smaller coins like XRP, Cardano and Solana dipped on the day.

BlackRock Inc.’s surprise June 15 filing with the Securities and Exchange Commission is among a flurry of US applications to start ETFs investing in spot Bitcoin. The SEC has resisted such funds but the heft of the world’s largest asset manager has led some to argue the agency might yet be persuaded.

“An approval would profoundly impact the market structure of Bitcoin, as it would reduce the barriers for financial advisers to offer exposure” to the token, Vetle Lunde, senior analyst at K33 Research, wrote in a note.

Aside from the ETF filings, crypto proponents seized on the start of a digital-asset exchange, EDX Markets, as evidence that traditional financial players see a future for the market. EDX Markets is backed by firms including Citadel Securities, Fidelity Digital Assets and Charles Schwab Corp.

The burst of optimism has overshadowed, at least for now, a US crackdown on crypto following last year’s $1.5 trillion rout and blowups like the bankruptcy of the FTX exchange amid allegations of fraud.

“There’s still probably negative regulatory news out there,” Bitwise Asset Management Inc. Chief Investment Officer Matt Hougan said on Bloomberg Television. “But the long-term outlook is looking exceptionally strong.”

Crypto investors have also shrugged off comments from central bankers that point to higher interest rates and diminished financial-market liquidity in the push to contain inflation.

“We’re looking at a meaningful narrative shift,” wrote Noelle Acheson, author of the Crypto Is Macro Now newsletter. “It’s becoming more crypto-specific, and that is a positive development on many fronts.”

©2023 Bloomberg L.P.