6h ago

Latecomers to 40% Tech Stock Rally Arrive in Time to See It Fade

, Bloomberg News

(Bloomberg) -- They waited and waited, then moved all-in. And now money managers who are finally surrendering to a shock first-half rally in equities must contend with the possibility its best days are over.

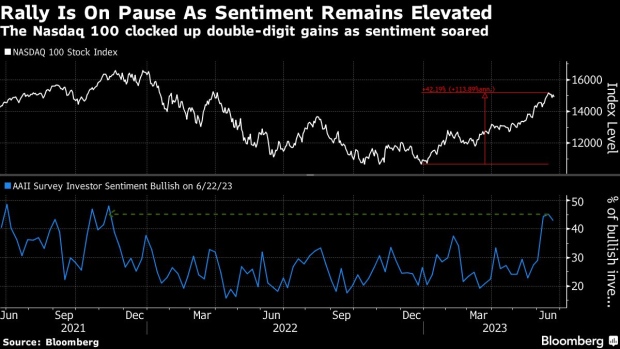

Just as a measure of investor exposure to equities jumped to the highest since April 2022, concern about a fickle Federal Reserve and widening recession fears halted the S&P 500’s longest weekly winning streak since 2021. The benchmark index slipped 1.4% over the four days, while the Nasdaq 100 lost 1.3%.

Whether just a breather on a longer ascent, or a peak, the jolt comes at an uncomfortable juncture for latecomers who for months resisted the lure of a tech rally that looks fragile under the threat of economic slowdown.

“We are on borrowed time, but it is important to participate in the market moves near-term,” said Nathan Thooft, global head of asset allocation at Manulife Asset Management in Boston, who has been boosting his exposure to technology shares in the last three months. “Late-cycle investing is notorious for this dilemma: when to become defensive while still participating as markets perform better than expected.”

Staying sidelined — or explaining to clients why you sat out a 40% rally — is the conundrum facing investors who may have already missed out on the biggest gains.

“As markets go up there are more and more fund managers joining it for fear of being fired,” said Fahad Kamal, chief investment officer at SG Kleinwort Hambros Bank Ltd.

Kamal has been growing increasingly bullish since abandoning underweight positioning on global equities in March. The fact that more investors have crowded into the rally as it snowballed doesn’t deter him — in fact he says it signals staying power.

“The odds have shifted in favor of this rally being the real thing,” he said. “A lot of people have been on the sidelines and long cash. Ironically that may provide a lot more runway for this rally to keep going.”

Retail investors embraced stocks ahead of this week’s slide. They scooped up $4.4 billion of equities during the week through Tuesday, a pace that’s two standard deviation above the 12-month average, according to public data on exchanges compiled by JPMorgan Chase & Co.

And sentiment is bullish. A Goldman Sachs Group Inc. index tracking views on stocks rose this month to the highest level since April 2021. A survey by HSBC Holdings Plc of the largest 60 asset managers show their views further out have turned dour even as short-term sentiment even has spiked.

Whether it’s the promise of productivity gains from artificial intelligence or the prospect that Corporate America can continue to churn out profit growth in line with long-term averages, there are defensible reasons equities have been buoyant.

That helped lure $19 billion into technology stocks in the prior two months, according to Bank of America strategists citing EPFR Global data. This was quickly followed by a $2 billion in outflows the week through Wednesday, the largest in 10 weeks.

There are many reasons for caution that some investors have started to heed. Among them are a deeply inverted yield curve, widening credit spreads and central bankers warning that they are far from done with the most aggressive rate hikes in decades. Valuations don’t help: US tech stocks are trading at 28 times prospective earnings, about 40% above the 10-year average.

And yet, fund managers have virtually been forced into a market that’s showing the first signs of fragility in weeks. Pictet Asset Management boosted exposure to tech stocks from neutral to overweight at the end of May, even while complaining that stretched stock valuations reflect “euphoric” risk appetite.

“While we don’t see clear negative catalysts in the short term, a reacceleration in economic momentum appears unlikely,” said Luca Paolini, the firm’s London-based chief strategist.

Then there’s the potential that any weakness gets viewed as a buying opportunity for anyone who missed the first-half gains. Take Friday, when a batch of data added to recession fears and the Nasdaq 100 fell as much as 1.5%. It ended down just 1%.

“We could well see a correction, a period of consolidation. But we think a lot of people missed the rally and their inclination is to try to think about where are we in this cycle and maybe buy into weakness,” said Nancy Curtin, chief investment officer at AlTi Tiedemann Global.

--With assistance from Sujata Rao.

©2023 Bloomberg L.P.