Homes were slightly more affordable in May than they were a year ago, according to new data from Ratehub.ca, though researchers warn the phenomenon may be short-lived.

Ratehub.ca looked at the average home prices in major Canadian cities in May 2023 and May 2022 and calculated the average annual income needed to buy a home. Affordability improved in eight out of the 10 cities included in the research.

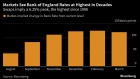

The report said the trend was a consequence of the Bank of Canada’s steep series of interest rate increases over the last year. That policy cycle has led to soaring mortgage rates and an elevated stress test used to qualify for a mortgage, now in a range of 7.39 per cent, up from 6.77 per cent last May.

“Combined with softer home prices in most markets across Canada, the overall affordability picture has actually improved,” the report said.

James Laird, co-CEO of Ratehub.ca, said in a written statement that it’s “not surprising” that affordability improved year-over-year with the changes in mortgage rates, stress test limits and softer prices in many markets.

“At this time last year, mortgage rates (and therefore the stress test) had already started to increase. Hence, the dynamic of a far higher stress test year over year has started to disappear,” Laird said.

WHERE DID AFFORDABILITY IMPROVE?

Hamilton saw the biggest decline in the income required to buy a home, as the average price dropped $105,200. Buyers in the southern Ontario city needed $9,520 less annual income to purchase a home last month than they would have a year earlier, with an income of $171,330 required to make a purchase at that price.

Victoria, B.C., ranked second on the list of more affordable housing markets, with the average income needed to afford a home dropping by $7,160 to $171,600. Ottawa came third with buyers needing $4,670 less in annual income to buy a home for $645,400.

Toronto ranked fourth on the list of cities with improved affordability. People needed $3,450 less annual income – at $222,600 per year – to afford a home in the city at an average price of $1.16 million.

Vancouver ranked sixth, with buyers needing $590 less annual income to afford a home for the average price of $1.19 million.

There were also affordability improvements in Edmonton, Montreal and Winnipeg.

WHERE DID AFFORDABILITY GET WORSE?

There were two cities where home affordability did not improve.

In Calgary, where the average home price increased year-over-year, buyers needed $7,420 more in annual income to buy a home.

In Halifax, people needed $3,400 more in annual income to purchase a home, as the average price only deceased “minimally,” by $9,500.

SHORT-LIVED TREND

Month-over-month real estate trends in May differed from the annual picture, and the report warned that “the narrowing year-over-year gap may be short-lived.”

“The tight supply of available homes for sale continues to put a boil under price growth, and support favourable seller conditions,” it said.

Home sales and national average prices ticked up in May from April, according to the latest data from the Canadian Real Estate Association – though at $729,044, the average price remained below the peak documented in February 2022 of $816,720.

The recent interest rate hike by the Bank of Canada, bringing its overnight lending rate to 4.75 per cent earlier this month, could further slow the housing market, the report warned, as it will “impact the borrowers already on the margins.”

“The resulting higher stress test will reduce the number of those who can qualify for a mortgage at today’s rates, particularly those who were already stretching their affordability. This could result in softening housing market activity in the coming months,” the report said.

Laird said the slight increase in housing affordability will even out before too long.

“By the end of 2023 we expect affordability to be flat year over year, since both rates and home prices will eventually be close to even when compared year over year,” he said.