Jun 12, 2023

Larry Berman: Fastest U.S. rate hike cycle in history has its Fed's dual mandate at odds

By Larry Berman

Larry Berman's Market Outlook

Minneapolis U.S. Federal Reserve president Neel Kashkari in an interview last month said, “If inflation is going to fall quickly … we might be in a position to be able to cut rates, if not this year, then soon in the new year. But if, on the other hand, inflation is much more persistent and much more entrenched … then I think the stresses in the banking sector probably become more serious.”

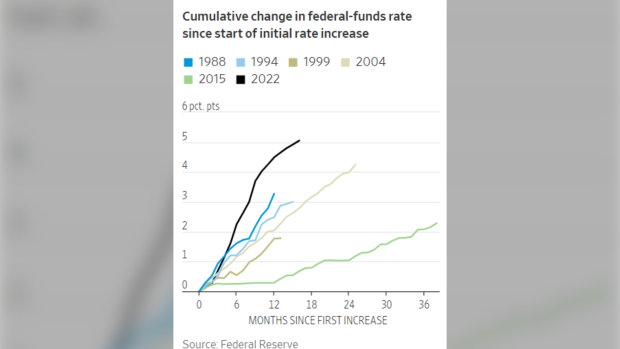

Kashkari was highlighting the difficulty the U.S. Federal Open Market Committee (FOMC) faces with the fastest rate hike cycle in history and their intended and unintended consequences.

The rapid rate hikes caused severe stress in regional banks in March, which led to the insolvency of two large banks and the takeover of another. In order to sooth the market, the FOMC applied their so-called separation principle. Emergency lending via regulatory tools to address the financial stability while continuing to fight inflation by raising rates. It was the higher rates that caused the stress for these banks and the issues have not been resolved yet. Because of this, banks are tightening lending standards, which should cool the economy.

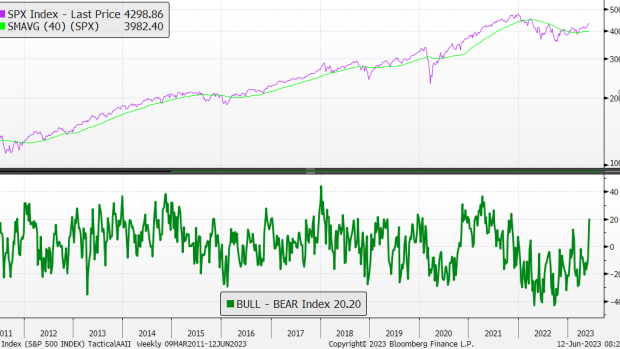

We still have the real economic impact of the credit tightening and job losses to face and we remain a bit surprised how equity markets are responding. From an American Association of Individual Investors (AAII) sentiment perspective, equity investors are now positioned bullishly, though not extreme yet compared to past peaks. These are the most optimistic readings since the last market top at the end of 2021.

The FOMCs other mandate is inflation, which will get a CPI update this week and based on the strength in equity markets, investors seem confident that inflation will come down so the FOMC can eventually cut rates. We are not so sure that core will come down fast enough.

Mohamed El-Erian has an opinion piece in the Financial Times that says, “If the Fed is genuinely data dependent and truly committed to achieving its current inflation target of 2 per cent, it should raise rates by 0.25 percentage points and leave the door open for additional hikes. However, if the Fed believes, as I do, that it is operating with an outdated inflation target due to significant changes on the supply side of the economy — and that the modification of the target requires a lengthy and delicate process — then it should opt for a pause with an inclination to cut when appropriate.” This would allow the effects of the previous rate hikes to permeate through the economy.

El-Erian writes that the Fed has experienced a significant erosion of its public standing and policy credibility. “There has been a prolonged discrepancy between the Fed’s communication on the path of rates for 2023 and what markets expect. Moreover, a public disagreement has arisen between the Fed chair and the central bank’s staff regarding the likelihood of a recession. The Fed’s reputation has been further undermined by costly slips in bank supervision, lack of a suitable strategic policy framework, weak accountability, and susceptibility to groupthink.”

The FOMCs own summary of economic projections has the unemployment rate rising to 4.5 per cent by the end of 2023. That in itself tells us they are forecasting a recession, but cutting rates now is just not an option given the persistence of core inflation. Their expectation for core PCE does not hit 2 per cent until the end of 2025 and they expect to cut rates in 2024.

This is what the market sees and probably why equities (a small handful) are doing really well this year while most are not. We have talked about the weak market breadth during this rally and it speaks to many of the policy divergences that lurk beneath the headlines. This week’s FOMC could add some clarity, but we expect U.S. Federal Reserve Chair Jerome Powell will double down on the higher for longer message. We’ll see how the market handles it.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com