Canadians’ mortgage borrowing hit the lowest level since 2003 amid higher interest rates.

Households added a net $11.2 billion in mortgage debt in the first three months of the year, according to national balance sheet data released Wednesday by Statistics Canada. That’s the smallest increase in two decades.

The report suggests higher borrowing costs are weighing on many households’ ability to access credit, though residential real estate prices recovered during the quarter as inventory remained constrained.

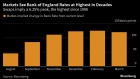

The slowdown in the net growth in mortgage debt coincides with one of the Bank of Canada’s most aggressive ever campaigns to raise to borrowing costs. After declaring a conditional pause in January, policymakers boosted the benchmark overnight rate to 4.75 per cent last week as household expenditures continued to grow.

Wednesday’s report likely represent a nadir for mortgage lending activity in the country. Data from April and May have started to show home price and sales activity building momentum in many Canadian cities.

Some of the weakness in net mortgage debt accumulation could also be the result of households deciding to pay down their mortgages in a higher rate environment. The report may raise questions about whether home purchases are being increasingly financed by non-mortgage means.

The release also showed Canadians remain among the most indebted people in the world: The ratio of household credit market debt-to-income rose to 184.5 per cent, up from 181.7 per cent in the previous quarter. The debt service ratio rose to 14.9 per cent, the highest since 2019.